Need to close your limited company? Whether you’re moving on, retiring, or simplifying operations, our expert team at BM Accountancy & Advisory will guide you through a clean, compliant, and stress-free company dissolution.

At BM Accountancy & Advisory, we understand that circumstances change. Whether you’re starting a new venture, retiring, or just winding things down, we’re here to help you close your company clearly, confidently and compliantly.

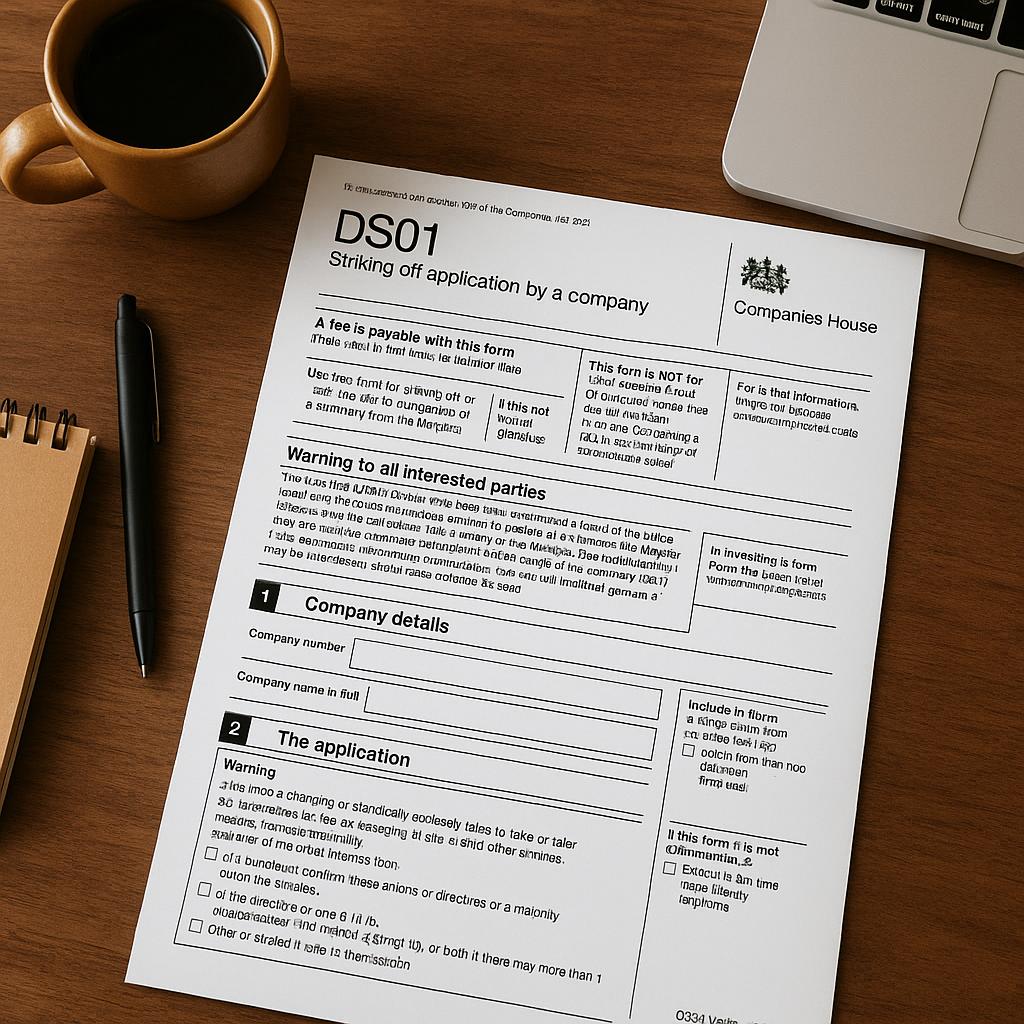

What is Company Striking Off?

Striking off (or dissolving) your company means formally closing it and removing it from the Companies House register. Once done, your company no longer legally exists.

When Can a Company Be Struck Off?

You can apply for voluntary striking off if your company:

- Hasn’t traded or sold anything in the last 3 months

- Hasn’t changed its name in the last 3 months

- Isn’t facing any legal or insolvency proceedings

- Has paid off all debts and closed all bank accounts

Not eligible? Don’t worry—we’ll advise on alternatives like liquidation.

What We’ll Handle For You

We take care of every step, including:

Eligibility check to confirm your company qualifies for striking off

Preparation and filing of DS01 with Companies House

HMRC notification and all required tax clearances

Advice on account closures and final bank reconciliations

Full compliance assurance—no loose ends or legal risks

Why Choose BM Accountancy & Advisory?

We handle the details, so you don’t have to. Our experienced and approachable team ensures everything runs smoothly from start to finish.

You’ll get peace of mind knowing your company is being closed correctly—with no surprises later on.

Ready to Close Your Company with Confidence?

We’ve helped dozens of UK businesses close with confidence—let us help you do the same.

Reach out today to book your free consultation

EXCELLENTTrustindex verifies that the original source of the review is Google. Excellent experience, even with short notice our accounts were completed within a couple of days. Would highly recommend.Posted onTrustindex verifies that the original source of the review is Google. Super happy with the services!! RecommendPosted onTrustindex verifies that the original source of the review is Google. Another year has passed, Taxed Paid. Thank you for your continued help with my accountancy. See you again next yearPosted onTrustindex verifies that the original source of the review is Google. Great service! Especially for my one-woman business. They always remind me when my stuff is due. Thank you, BM AccountancyPosted onTrustindex verifies that the original source of the review is Google. Amazing services and support from BM Accountancy. Baraka is an absolute gem - always professional, knowledgeable, friendly and helpful. Our businesses have benefitted immensely from your services and we will keep recommending you across our network.Posted onTrustindex verifies that the original source of the review is Google. Great accountancy firm. I mainly use for corporation tax purposes and they are very efficient and accomodating!Posted onTrustindex verifies that the original source of the review is Google. I’ve been working with BM accountancy firm for the past 2 years, and I couldn’t be happier with their service. They are knowledgeable, professional, and always available to answer my questions. Thanks to their clear advice and attention to detail, my accounts are always in order and deadlines are stress-free. Highly recommend for both personal and business accounting needs!"Posted onTrustindex verifies that the original source of the review is Google. Wow!!!!!!!!!!! The service rendered was superlative as my English teacher used to say. I was made to feel super important and the tax advice given was exceptional. I would always recommend your services to my network.Posted onTrustindex verifies that the original source of the review is Google. Excellent service! ✨ As an entrepreneur, numbers and setting up tax admin for your startup can be overwhelming. Baraka assists you through each step with grace and genuine professional advice on the most suitable financial approach for your small business. Positive and bubbly rather than cold and transactional — that’s the cherry on top. Two years in, and very pleased. Highly recommended for any entrepreneur navigating early-stage finances!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Menu

© 2025 BM Accountancy & Advisory. Lovingly built by Highfi Tech